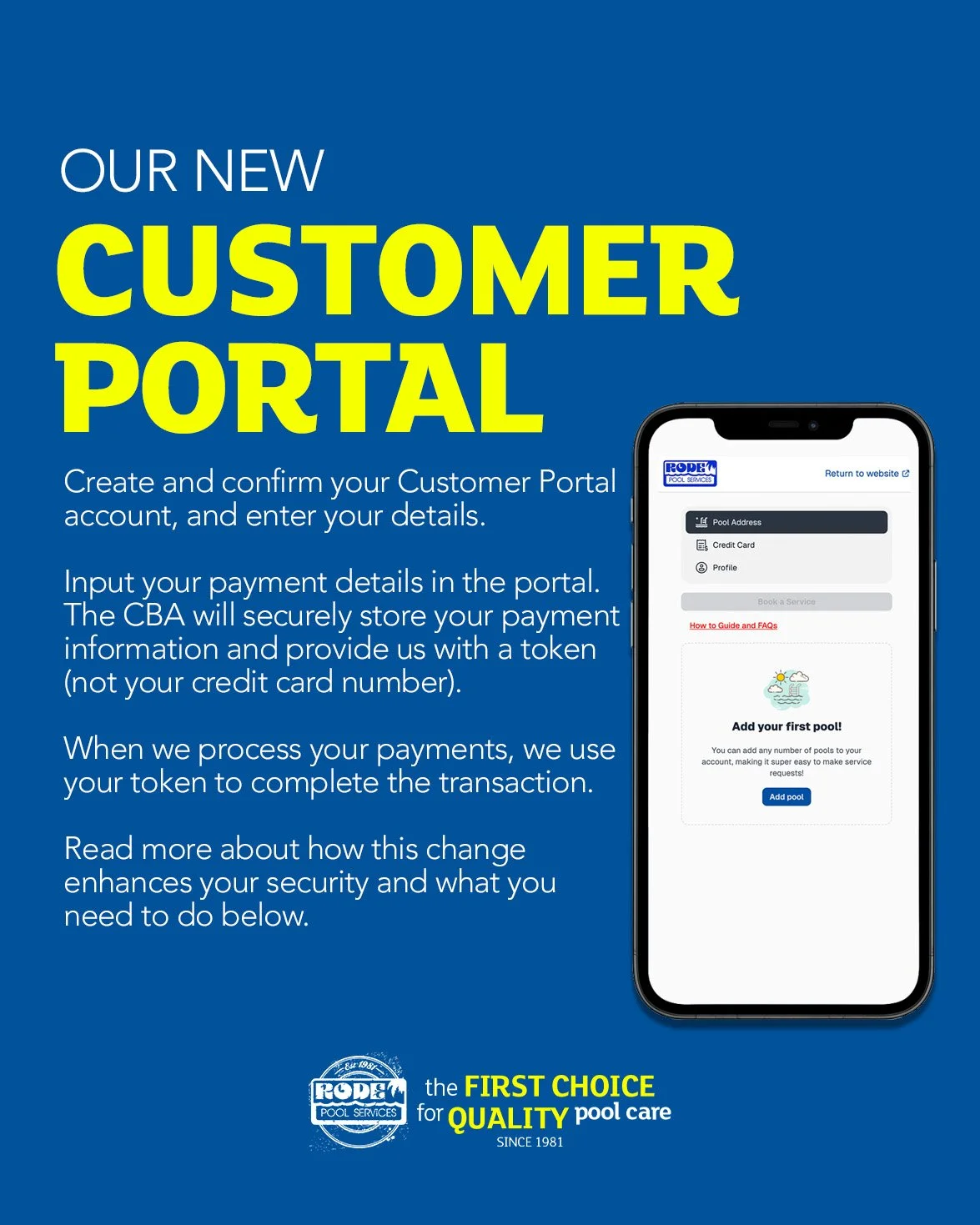

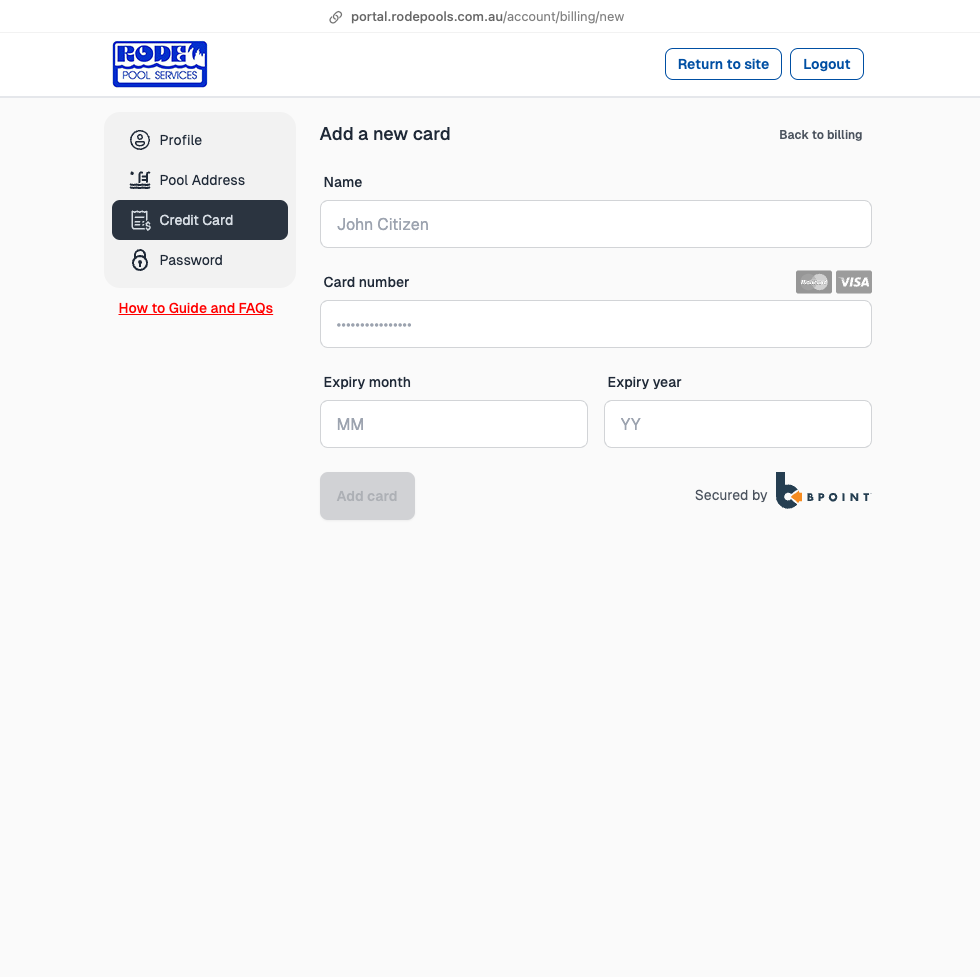

To ensure that your data and personal information are safe, we have developed our own secure customer portal to house your personal details which connects directly with the Commonwealth Bank to privately and securely handle your payment information.

By doing this, your credit card information will never be visible to our staff. The full card number, security code (CVV), and other sensitive payment details are encrypted and sent directly to and stored with the CBA under their highest levels of security.

Use these quick step guides to set up and update your portal account, or read our FAQ’s here

Need help or have a question? Send us an email at portal.support@rodepools.com.au

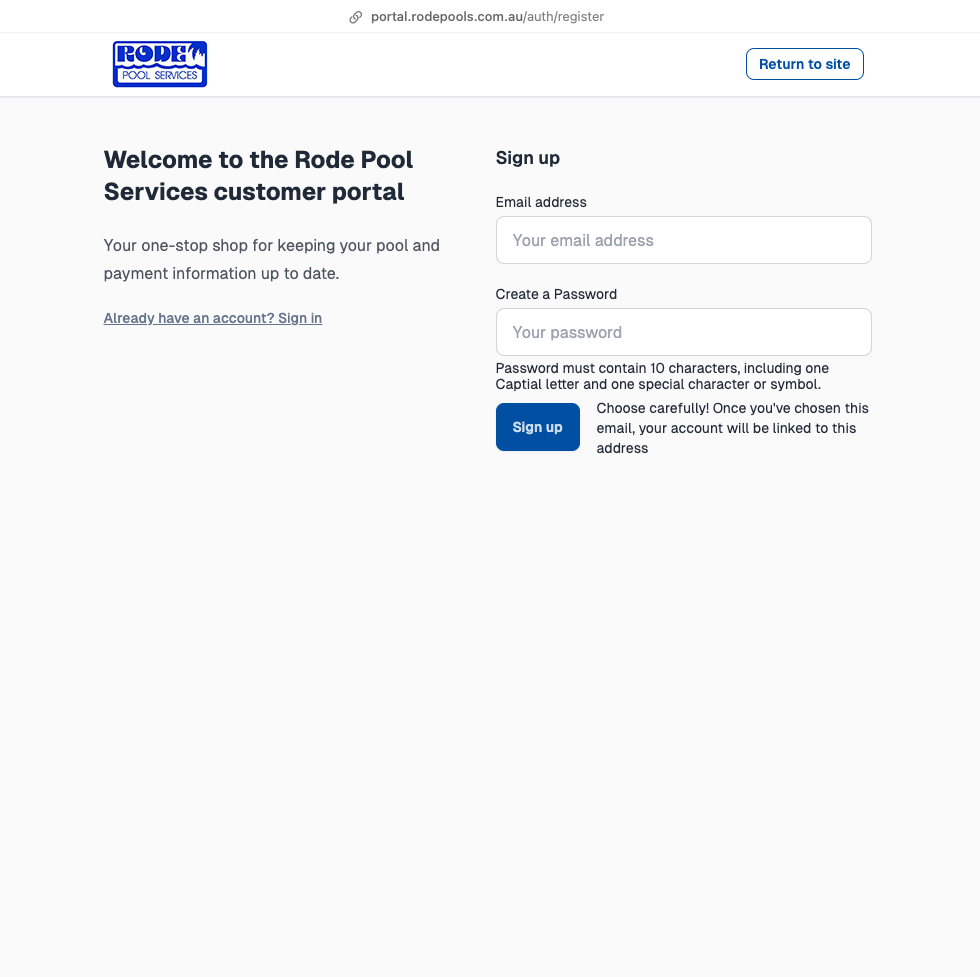

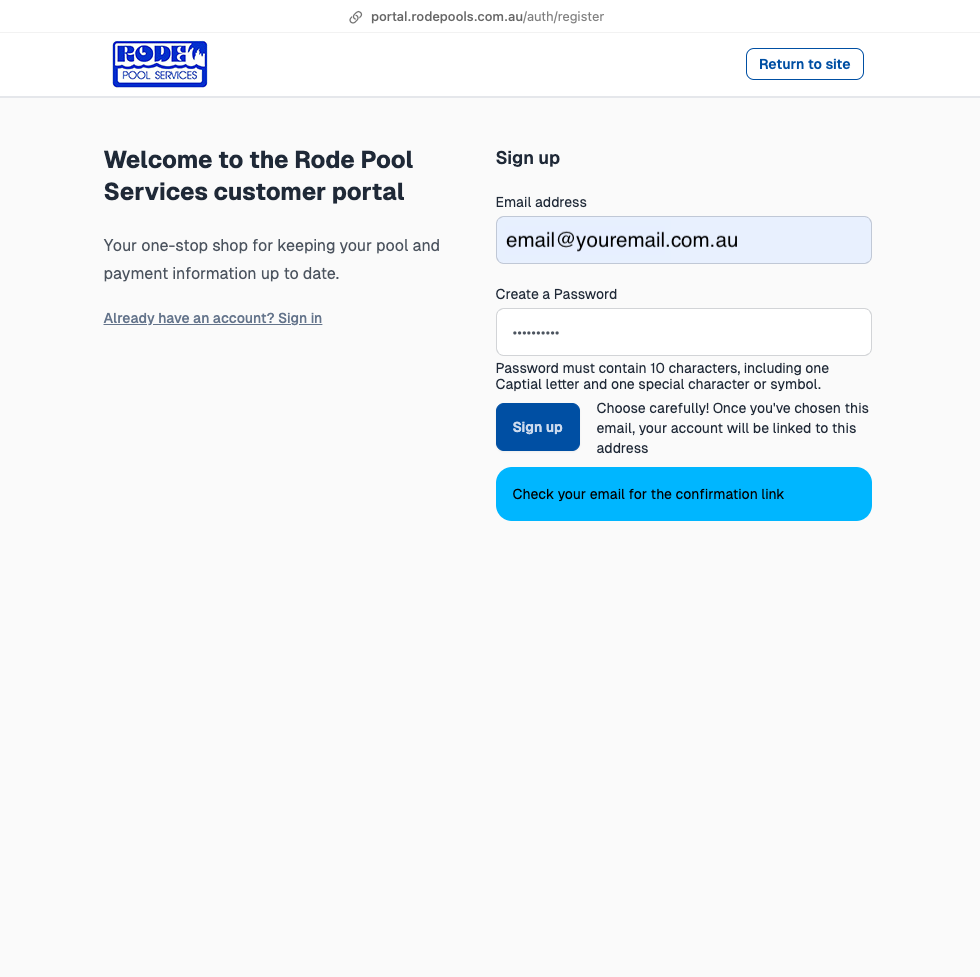

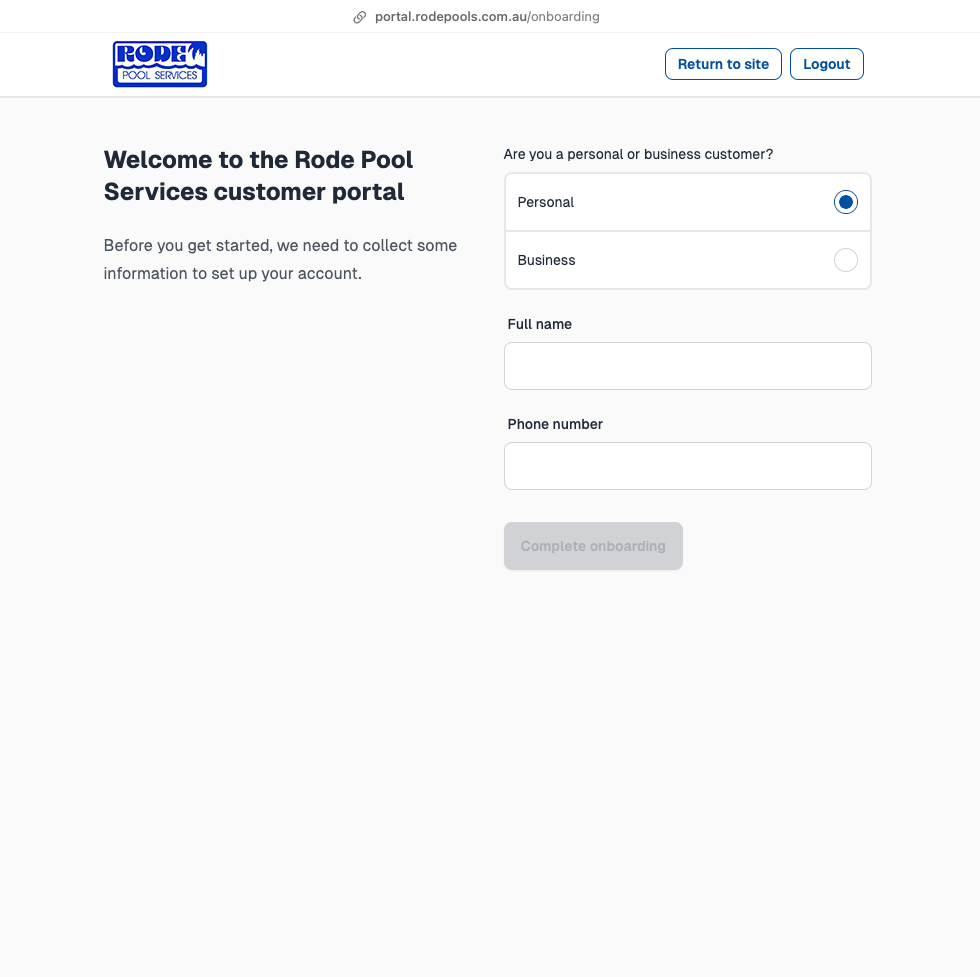

Steps to Register and Set Up Your Account

FAQs

What data do we have access to?

We have all your required details to carry out our services, such as your name, address and phone numbers. For payment verification and support purposes, our staff will only have limited visibility of your payment method - specifically the last 4 digits of your card, the card type (e.g., VISA), and the expiry date. This minimal information allows us to assist with payment inquiries and confirm which card is being used without exposing your sensitive financial details.

How are we securing your data? Your customer account in our portal is secured by your own password, which you choose and we cannot see. When you enter your payment information into our customer portal, it is encrypted and sent directly to the Commonwealth Bank for tokenization, whereby your card details are substituted with a random string of numbers (a token) that they send back to us to keep. The complete card number, security code, and other sensitive details are never stored in our systems; all we keep is the token and the minimal verification information mentioned above.

What is Tokenization?

In payment and banking terms, tokenization is the process of replacing sensitive information, such as credit card numbers, with a unique identifier called a token. The token is used to represent the original information in transactions, without exposing the actual data, thus enhancing security and protecting against fraud and data breaches. Tokenization helps reduce the scope of sensitive data stored and processed, while still allowing transactions to be processed effectively.

What does a token look like?

In payment and banking terms, tokenisation visually and structurally transforms sensitive payment data into a secure, non-sensitive format. Here’s what it typically looks like:

Token: 6f93a5d0-7b8c-49d3-8c0f-9823e69c6a41

Cardholder Name: John Citizen

Expiration Date: 12/28

How do we process your payments?

When your invoice is due for payment, we ask the bank to process your token, which is matched with your payment information stored by them for the amount on your invoice. We send them your token and the amount to process, then they match the token we’ve sent with the one they have, which then matches your card number and the payment is processed.

Do you have more questions? Contact us at portal.support@rodepools.com.au